Sitting on cash. All-time market highs. Upcoming election. COVID-19.

What’s an investor to do?

Sitting on cash. All-time market highs. Upcoming election. COVID-19.

What’s an investor to do?

The economy is not the market.

Decision-making and trade-offs.

Living better at 70, 80 and beyond!

Space X and innovation.

Instead of trusting headlines for investing, here's what you should do.

Building off of Part 1, we explore what it means to talk about "the market" and talk about some concepts of how you should think about investing.

Good news on the vaccine development.

Don't rely on headlines.

The meaning of Memorial Day.

Advanced Planning can include several different areas and topics with numerous options for strategies or action. One topic involves saving money and saving taxes in the most efficient way. In this webinar, we review some tax-deferred savings opportunities via qualified retirement plans. We also explore the benefits of tax-deferred savings vs after-tax savings.

Be sure to check out other webinars on The Baer Facts webpage.

Round 2 of the PPP Stimulus Package is here plus what to look forward to around town as things start to re-open in Georgia.

Things to consider about balancing your investment portfolio - do you know what you’re invested in?

A suggested 4-step approach to managing your emotional roller-coaster.

We’re bringing you another webinar that is part of our ongoing series to help you build Your Financial Success Matrix. Previously, we talked about one of the staples of any financial planning foundation - the emergency fund.

This week, we’re talking the basics of investing. No matter how sophisticated of an investor you are, you’ll get a lot out of this topic. How would you define a stock and a bond? What are some common risk-return trade offs? What does it take to realize investing success? There is no free lunch…we’ll help you unpack all of this in Investments 101.

Updates on Congress’ $2 trillion stimulus package; how it has impacted the markets; and controlling what you can control.

We’ve put together an enhanced communication strategy to keep you up-to-date on all you need to know. It will include one update each Friday and two webinars each month. That way, you won’t have to expend as much time and energy throughout the week…you have many other important things to focus on! However, we’re always here for you whenever you need, 7 days a week.

Our best advice this week comes from Lisa - spend this weekend disconnecting from devices and distractions; devote yourself to spending quality time with your family and loved ones.

COVID-19 (coronavirus) is impacting people and markets in significant ways. Markets globally continue to be under stress and volatile. More importantly, the health of many people in the US and abroad is at risk. These are uncertain times that have understandably caused anxiousness for many. Below is a recording of our update from March 16, 2020.

Note: This article was published by David Booth, Executive Chairman and Founder of Dimensional Fund Advisors. The original article can be found here.

I have worked in finance for over 50 years, and it seems that every January the same thing happens. Lots of folks look back at last year’s performance to draw conclusions they can use to predict what markets will do in the year to come. I don’t make predictions, but I do think it’s worth answering this question: What are the lessons from 2019 that we can apply to 2020?

Let’s go back to where we were this time last year. The words running across CNBC’s home page were, “US stocks post worst year in a decade as the S&P 500 falls more than 6% in 2018.” The Wall Street Journal summarized the state of market affairs with this headline: “U.S. Indexes Close with Worst Yearly Losses Since 2008.” Amidst gloomy predictions for 2019, I posted a video on the limitations of forecasting.

Things felt ominous. We started the year with a lot of anxious people. Some decided to get out of the market and wait for prices to go down. They thought that after 11 years, the bull market was finally on its way out. They decided to time the market.

We all know what happened. Global equity markets finished the year up more than 25%1, and fixed income gained more than 8%.2

Missing out on big growth has as much impact on a portfolio as losing that amount. How long does it take to make that kind of loss back? And how is someone who got out supposed to know when to get back in?

The lesson from 2019 is: The market has no memory. Don’t time the market in 2020. Don’t try to figure out when to get in and when to get out—you’d have to be right twice. Instead, figure out how much of your portfolio you’re comfortable investing in equities over the long-term so you can capture the ups and ride out the downs. A trusted professional can help you make this determination, as well as prepare you to stay invested during times of uncertainty.

Not enough “experts” subscribe to this point of view. They’re still trying to predict the future. You’ve probably heard the saying, “The definition of insanity is doing the same thing over and over again and expecting a different result.” I’ve been seeing people make this same mistake for 50 years.

We’ll never know when the best time to get into the market is because we can’t predict the future. And if you think about it, that makes sense. If the market’s doing its job, prices ought to be set at a level where you experience anxiety. It’s unrealistic to think the market would ever offer an obvious time to “get in.” If it did, there would be no risk and no reward.

So what should you do in 2020? Keep in mind 2019’s most important lesson (which is the same lesson from every year before): Stay a long-term investor in a broadly diversified portfolio. Reduce your anxiety by accepting the market’s inevitable ups and downs. Make sure the people advising you align with your perspective. Stop trying to time the markets, and you’ll find you have more time to do the stuff you love to do.

You may have heard of a big game happening in Atlanta on Sunday: Super Bowl LIII. (Do you remember what the Roman Numerals equate to?) The City has spent the past several weeks preparing for the estimated 150,000+ out-of-town guests to arrive, while over 1 million people are expected to attend the series of festivities leading up to the game.

This year’s match-up pits the Patriots vs. the Rams – two very different organizations. The Patriots are led by 41 year-old quarterback Tom Brady and coach Bill Belichick, who need no introduction. This organization has been the gold standard of the NFL for the last two decades, having been to 9 Super Bowls and winning 5 of them (much to the dismay of Atlantans).

On the opposite side of the field are the Los Angeles Rams, led by a 33 year-old energetic coach in Sean McVay and a 24 year-old quarterback, Jared Goff. The Rams are new to Los Angeles as of 2016, having spent the previous 20 years in St. Louis. By all accounts, a young organization in the NFL.

That’s right, the Patriots’ quarterback playing the game is 8 years older than the Rams’ head coach, and he was basically graduating high school when the Rams’ starting quarterback was born! But here they both are, playing a final 60 minutes to lift the Lombardi trophy and be crowned the champions.

————

If we look back at the performance of the NFL’s two leagues – the AFC and the NFC – over the last 10 years, is it any surprise that the Patriots and the Rams are playing in the Super Bowl?

The following charts show the playoff seeding of the AFC and NFC over the last 10 years, from 2009-2018. Note that it does not show how those games actually played out (i.e. #6 Atlanta beat #3 Los Angeles in 2017) because there is no final seeding after the games are played – just that the winners advance.

When looking at the NFC, what are your takeaways? Is it clear who was the best team over this decade? Atlanta has made the playoffs 5 times, but has nothing to show for it. New Orleans has 6 appearances and 1 Super Bowl victory. 40% of the time they didn’t even make the playoffs. Philadelphia has 5 appearances and 1 Super Bowl victory. 50% of the time they didn’t even make the playoffs. Green Bay has 7 appearances in the last 10 years but “only” 1 Super Bowl victory…should those odds be better? Meanwhile, the NY Giants have missed the cut on 80% of the last 10 playoffs, but they have the same number of Super Bowl victories as Seattle, New Orleans and Philadelphia.

The truth of the matter is that in hindsight, we could say that the Green Bay Packers appear to have been the cream of the crop in the NFC for much of the last 10 years. I think that is a reasonable statement. But in any given year, there was no guarantee what would happen, and certainly no accurate forecasts at the beginning of the season.

Now let’s look at the AFC. This one is a little different in that it is pretty easy to notice that the league was dominated by just a few teams. The aforementioned New England Patriots, the Denver Broncos and the Pittsburgh Steelers. In hindsight, we feel pretty good about saying, “Well, no wonder these teams were in the playoffs nearly every year and winning Super Bowls. Any fool could have predicted that.” Truth is, they might be right; but this has more to do with each of those teams having dominant, long-term quarterbacks that led their teams to victory. Tom Brady, Peyton Manning and Ben Roethlisberger are all future Hall of Famers.

Picking one of these 3 teams, you like your chances of being right. However, Pittsburgh made the playoffs just 6 out of 10 years; Denver just 5 out of 10 years. They each have 1 Super Bowl victory over this time period. (Also note that Kansas City, Indianapolis, Cincinnati, and Baltimore all have 6 playoff appearances as well).

Ah yes, the New England Patriots. 10-for-10 in playoff appearances. 5 Super Bowls played in, with 2 trophies hoisted (one will be determined on Sunday). Well, there is such a thing as periods of out-performance, and they have certainly enjoyed that over the last decade. But it is just as important to note that they had just 5 playoff appearances in their first 25 years in the league!

————

The same holds true in investing. Each year, there are winners and there are losers among the different asset classes around the globe. Like the AFC and NFC playoff charts above, the below chart provides no decipherable information as to where the best place to invest your money is, or when.

Source: Dimensional Fund Advisors

Anything can happen from one year to the next. If you don’t believe me, take a look at what Emerging Markets did in 2008 and 2009.

So what can we learn from all of this?

First, that past performance does not guarantee future results.

Second, that it is impossible to predict what will happen. We’re fooling ourselves into thinking we have some absolute knowledge that, in reality, is based on bias or emotion.

Third, that there can be periods of out-performance (S&P 500 from 2010-present and the Patriots over the last 20 years) relative to peers as well as periods of under-performance (S&P 500 from 2000-2009 and the Patriots of the 1970s and 1980s). However, there is no data to suggest that it is likely to persist in the future.

One thing we can all agree on: it is time for Tom Brady to retire.

I have money in savings and want to invest it. Should I wait until after Tuesday, November 6 – the midterm elections – to get my money invested?

No matter who you are, there are likely two things that have crossed your mind recently: market volatility and political discourse. Thus, it would seem natural that both factor together when deciding whether now is the time to invest idle cash.

I was recently asked this very question, and along with that, I was asked what the market did recently. My response was that the market was higher than where it was a week ago and lower than where it was a month ago.

But so what? That is what the market has done. It does not tell us anything about what the market will do. And there is certainly no such thing as what the market is doing. Notice the subtle, but extremely important, differences there.

Markets don’t always act in ways that we think are rational. It is impossible to silo independent drivers of what makes the market go up or down for any given period of time. Election day, tariffs, taxes, earnings reports, jobs reports…these are all just some of the factors that we’ve heard about recently which work in beautiful harmony and can impact what drives market movements. Or at least our perception of what drives market movements.

To decide whether now is the time to get cash invested, focus instead of what you know and what you can control:

1. We know that mathematically speaking, a dollar invested today has a higher expected return than a dollar invested tomorrow. Simple enough concept, but there is more to it than that behaviorally.

2. How much cash am I looking to invest relative to my overall wealth or net worth? Is it a material amount or just another contribution in a long line of contributions?

3. What is the money for? It goes without saying that if you’ll need this money for something in the short term, then it likely should not be invested at all. If this money is for long term wealth building and/or retirement, then it should be invested according to your overall investment strategy in accordance with your specific risk tolerance.

If you’re investing for the long-term and have an investment strategy in place, then what happens this week, next month, or the next 12 months is almost irrelevant. It’s also unpredictable.

Notice we haven’t even touched on the psychological factors that go along with sitting on cash. That is vitally important to understand, and we’ll cover that next time.

Last week was a wild, wild week.

For a few days, it was one of those weeks where we were reminded what it feels like to lose money. On Wednesday, we experienced a very rough day in the market. S&P was down 3.29%, Dow down 3.15%, Nasdaq down 4.08%. In fact, it was the worst day in the market since February. Eight whole months – an eternity! Thursday was not any better.

Here comes Friday, with surging stocks and the S&P 500’s biggest gain since April 10. What are we to make of all of this?

If you’re like many, you turned to news outlets to get a better understanding and probably saw things like “Fed policy: crazy or sane?” or “S&P 500 rises for first time in 7 days” but still having “Worst month since March” but at the same time “Nasdaq has biggest jump since March.” By the way, all of the aforementioned headlines came in one 15-minute window on Friday morning. Make sense yet?!

To be blunt, I do not recommend you changing your investment strategy based on what happened last week, this past month, or even this year. If what happened last week has left you in emotional distress, you may need a reality check. Returns are only possible by taking risk. Rather than chasing returns, it’s imperative that you understand the risks you take in your investments.

Arguably the biggest rule about investing is that no one has a crystal ball. Worth repeating – no one can predict what will happen and when. It’s not cliché…it’s reality!

The best remedy for a week or month like we just experienced is having an investment strategy. Whether you are a DIY’er or work with an advisor, you should have a strategy and know what that strategy is well in advance of any shakeups.

However, even when we have reasonable evidence that a particular investment strategy will work, the hardest part is the discipline it takes to stick to that strategy through thick and thin. It is so difficult because that little voice in your head says, “What if this doesn’t work anymore? What if I’m wrong? What if my neighbor/friend is supposedly doing better than me?” Often times, that little doubt is all it takes to turn steadfastness into the emotional turmoil that has ruined generations of investors.

The key to successful investing as I see it is two things, listed in order of importance.

Stay disciplined. This requires hard work. It’s easy to be disciplined when everything is going your way, but it’s much harder when the tide is turned against you.

Remain diversified. Over-concentration of investments (to one company, one sector, one asset class, or one country) is one of the top reasons anyone ever ends up bankrupt and has a poor investment experience.

Last week was a wild, wild week. It felt like that 2010 Wimbledon match between John Isner and Nicolas Mahut. You know, the one that started on a Tuesday and ended on a Thursday? Where the 3rd and 4th sets went to a tie-break, and the match finally ended in the 5th set at 70-68. You remember, because it was emotional!

Recently, we took a look at the S&P 500 which included a great visualization of the market cap of companies that make up the index.

To many in the investment world, the stock market is still on its bull-market run (though there is some disagreement on the technical length of it). This means that companies which make up the index have grown in value as a whole. Individual companies have jockeyed for position with some being added to the list of largest 500 companies in the U.S. while others have fallen off.

Josh Wolfe brings us another great visualization comparing the 10 largest companies in the S&P 500, from March 2009 to August 2018.

Time surely flies, and there are so many historical lessons gleaned from market data. Arguably none more obvious than the rise of Amazon. But what about the tumultuous decade that Bank of America experienced? Or the fall of IBM, relatively speaking? Only three companies in the top 10 in March 2009 remained there in August 2018.

Perhaps the most simple lesson learned from a chart like this is that we don't know what will happen in the future. What we believe to be the best companies at the current time may fall off in the not-too-distant future. Companies that we don't yet know anything about or are not evenly publicly traded may one day dominate the headlines and market share.

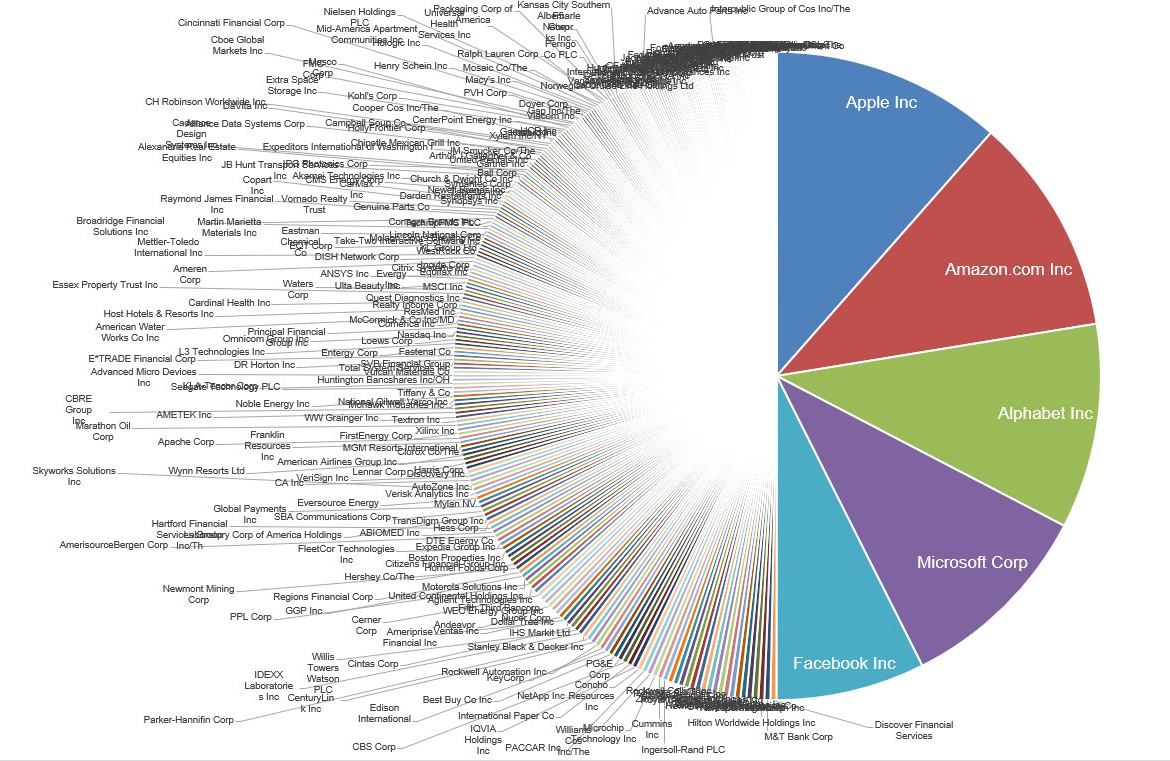

The S&P 500 is an index of the 500 largest U.S. companies. It is market-capitalization-weighted based on those companies' values. When people talk about "the market," they are often referring to the S&P 500 (other times the "Dow" which is an index of just 30 stocks).

Michael Batnick, Director of Research at Ritholtz Wealth Management, took the finance world by storm recently by putting together the following chart and data. He points out that the market cap of the top 5 S&P 500 companies is $4,095,058,706,432 while the market cap of the bottom 282 S&P 500 companies is $4,092,769,755,136 (as of July 2018).

Astounding!

What we can learn from this is that there are a few select companies that can control the narrative of "the market." These are companies that we all know, recognize, and may even love. But that should not dictate how we invest.

It's true that FAANG and other mega-cap stocks have performed well, but so have companies in other deciles of the S&P. It is just as important to remember that there are about 3,000 other publicly-traded companies in the US and thousands more abroad.

Diversifying your financial portfolio is the best way to ensure you are protected in all kinds of economies. That means your investments in the stock market should be diversified, but it also means your money should be working for you in several different sectors. Easily accessible savings or money market accounts, stocks, bonds, retirement accounts and real estate are all important to have in your repertoire. Finding the proper balance is key. This piece from CNN.com explores the risks of avoiding risks. When you keep a large percentage of your net worth in the bank rather than investing it, you miss out on returns that could mean a much more comfortable retirement. It's worth the read. Please feel free to contact me if you would like to discuss your own financial portfolio and whether it is setting you up for the future.

Every time you order chicken breast and roasted vegetables instead of lasagna, you are making a healthy choice that, if you are consistent, will pay dividends to your future self.

Every time you decide to go to the gym, even though you are tired and would prefer to spend the time with Netflix and your couch, you are taking a step toward a healthier future.

But ask yourself this: Are you taking steps to be sure your financial future is healthy?

If the answer is no, the most important thing you can do -- consistently -- is very simple. Pay yourself first.

When you work up your budget, the category at the top of the list should be SAVINGS. This includes 401k and/or IRA if it is not automatically taken out of your check, an emergency fund savings account, an investment account, and a traditional savings account.

Paying yourself can easily be done by a direct deposit that you set up with your bank. If the money goes out of your check and into savings automatically, you won't see the money, you will learn to live on the balance of our paycheck and you will be financially able to handle unexpected expenses that happen to all of us. You will also be setting your future, retired self up for a comfortable life without having to worry about when your next social security check will arrive.

Let's take a look at each category:

401k/IRA - It is critical to be good to your future self by saving for retirement while you are in your early and peak earning years. If you start early, the money you put away has decades to compound. Most employers will match a certain percentage of the money you save. Don't leave this free money on the table!

Emergency Fund - Put money aside in an emergency fund for the unexpected -- your roof springs a leak, your hot water heater dies, you need expensive dental work. Without an emergency fund, many people put these expenses on their credit cards and wind up paying that debt down for years. In addition, a longer term goal is to save at least 3 months of living expenses in the emergency fund in case you lose your job and your income is interrupted.

Savings Account - This is for expected expenses that may not be included in your monthly budget. For example, your twice yearly car insurance payment, saving for a vacation or for a new car.

Investment Account - Watch your money grow when you invest in mutual funds and bonds. It is simple to set up an investment account with a brokerage house like Vanguard or Fidelity, and if you deposit even a small amount each paycheck, you will see your money grow over time. The stock market offers a potentially higher return on your money than a savings account and will help you keep up with inflation.

I talk to my clients all the time about the need to grow their wealth by investing in companies designed to generate profits for their shareholders, being consistent with investing and resisting the urge to take money out when the market goes through inevitable downturns.

A few weeks ago, Berkshire Hathaway CEO Warren Buffett crystalized this advice with an example that I think is worth sharing.

Buffett talked about the difference between investing in stocks and investing in gold. Gold is often considered a "safe" investment and one many people turn to when the markets are volatile.

Here is what he found:

If you invested $10,000 in a S & P Index Fund in 1942 (the year he began investing), your investment would be worth $51 million today.

If you invested the same amount in gold in 1942, your investment would be worth $400,000 today.

"For every dollar you could have made by investing in American business, you would have less than a penny of gain by buying into a store of value which people tell you to run to every time you get scared by the headlines," Buffett said.

This example perfectly illustrates why it is so important to invest as early as possible and remain disciplined about staying in the market for the long haul.

Your future self will thank you.